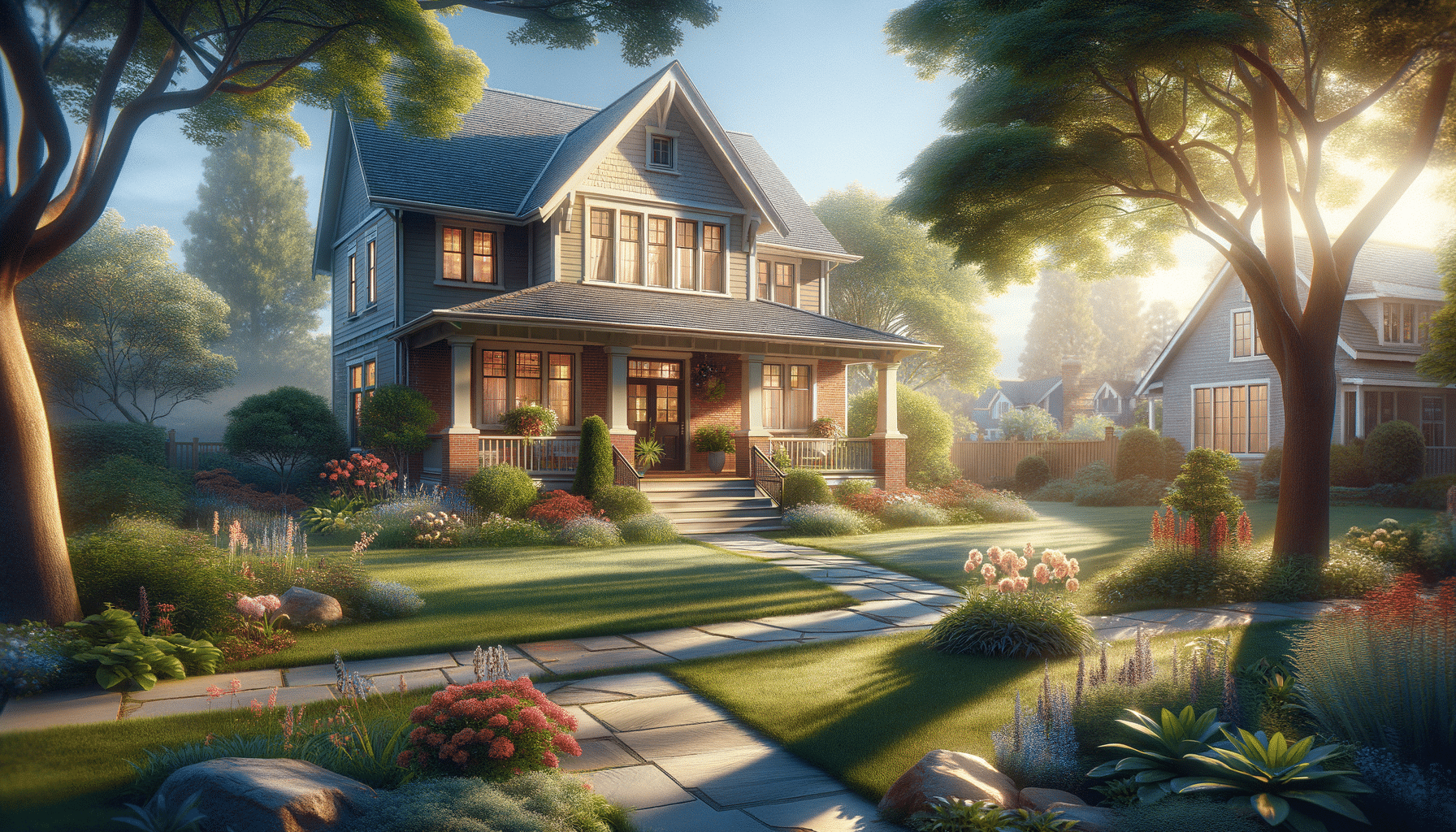

Your Guide to Rent-to-Own Homes — From Listings to Finding What You Need

Introduction to Rent-to-Own Homes

Rent-to-own homes offer a unique pathway to homeownership that combines the flexibility of renting with the potential benefits of buying a home. This arrangement can be particularly appealing to individuals who are not yet ready to commit to a mortgage but want to work towards owning a property. This article explores the rent-to-own model, its advantages, and how it can be a viable option for many aspiring homeowners.

Understanding the Rent-to-Own Agreement

A rent-to-own agreement typically involves two main components: a rental lease and an option to purchase the property at a later date. During the lease period, tenants pay rent, and a portion of this payment may go towards the future purchase of the home. This setup allows tenants to “test drive” the property and neighborhood before making a full commitment.

Key elements of a rent-to-own agreement include:

- Option Fee: An upfront fee that secures the right to purchase the property in the future.

- Rent Credit: A portion of the monthly rent that is set aside and applied towards the purchase price.

- Purchase Price: The agreed-upon price of the home, typically determined at the start of the lease.

Understanding these components is crucial for anyone considering a rent-to-own arrangement, as they dictate the financial and legal responsibilities of both parties involved.

Pros and Cons of Rent-to-Own Homes

Rent-to-own homes come with a variety of benefits and drawbacks that potential tenants should carefully consider.

Some advantages include:

- Flexibility: Allows tenants to build credit and save for a down payment while living in the home they plan to purchase.

- Price Lock: The purchase price is typically locked in at the start of the agreement, which can be beneficial in a rising market.

- Test Living: Provides an opportunity to live in the home and assess its suitability before buying.

However, there are also potential downsides:

- Non-Refundable Fees: Option fees and rent credits are typically non-refundable if the tenant decides not to purchase the home.

- Legal Complexities: These agreements can be complex, requiring careful legal scrutiny to avoid unfavorable terms.

- Market Fluctuations: If the market declines, the agreed purchase price might be higher than the current market value.

Weighing these pros and cons can help potential buyers decide if a rent-to-own home is the right choice for them.

Finding Rent-to-Own Listings

Locating rent-to-own listings can be a bit more challenging compared to traditional rental or home purchase listings. However, with the right approach, you can find opportunities that match your needs.

Here are some strategies to consider:

- Online Platforms: Utilize specialized websites that focus on rent-to-own properties.

- Real Estate Agents: Engage with agents experienced in rent-to-own agreements who can provide valuable insights and access to listings.

- Local Advertisements: Check local newspapers and community boards for rent-to-own opportunities.

Being proactive and patient is key when searching for rent-to-own homes, as these listings can be less common and may require diligent effort to uncover.

Conclusion: Is Rent-to-Own Right for You?

Rent-to-own homes present a compelling alternative to traditional home buying, especially for individuals who need more time to secure financing or want to ensure a property suits their long-term needs. By understanding the intricacies of rent-to-own agreements, weighing the pros and cons, and knowing where to find listings, you can make an informed decision about whether this pathway to homeownership aligns with your personal and financial goals.

Ultimately, rent-to-own is not for everyone, but for those who find it suitable, it can be a strategic step towards achieving the dream of owning a home.